'In a post on the New York Fed's blog on Wednesday Jonathan McCarthy, VP at the Fed's research and statistics group, took a look at how sluggish the recovery in consumer spending has been since the financial crisis.

"Discretionary expenditures have picked up noticeably over recent quarters," McCarthy writes. "But, unlike spending on nondiscretionary services, they remain well below their pre-recession peak. Even so, the pace of recovery for both discretionary and nondiscretionary services in this expansion is well below that of previous cycles." ' ~Business Insider, 8/6/2014 link

As to why this recession is so much more devastating than previous ones, in my opinion, we can look to the inequity of income. The people who actually spend the money do not have the confidence or resources to spend.

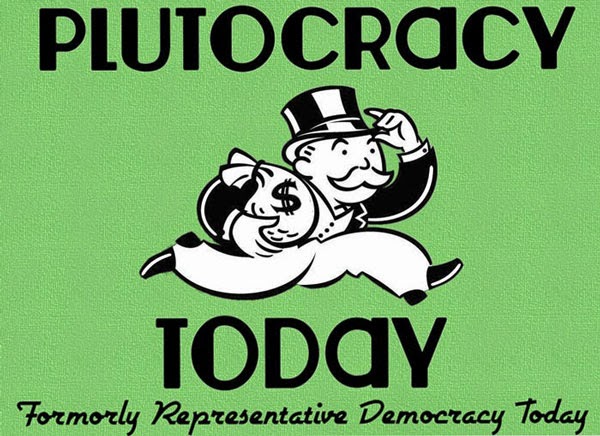

I see good and bad in the decline of consumerism, but I see mostly bad in the hoarding of the fruits of labor and capital by the wealthy with their seemingly endless influence over the government and business affairs.

The Fed can do a lot to make sure there is enough money to fuel a recovery in a Keynesian way, but they apparently have little say so about getting the money into the hands of people who will actually use that money in the economy to make the Keynesian model of growth work effectively. For instance, money borrowed with cheap interest (the Fed's main playing card to inject money into the economy) can just be used to bid up imaginary stock values with no real effect on non-imaginary service or commodity transactions. If you wonder why there are Fed statements to tamp down the speculation, I would guess this would be the reasoning.

Or putting it more simply, "Fat Cats" with money do not positively influence the economy in at least the short term. We need to wait for the trickle down. And wait, and wait, and wait. I like it put more simply. :)

I am open for debate but it is clear to me. I have faith in the power of money to corrupt the system.